Outsourced Services

An Outsourced Centre of Excellence for Compliance

Increased regulatory scrutiny and heightened global standards requires all financial institutions to constantly upgrade and improve. This is leading to an ever-increasing surge in AML operational volumes. This, coupled with traditional IT systems and manual workflows, has resulted in an increasing cost of AML/KYC compliance.

An outsourced service is a natural solution as financial institutions are struggling to expand their AML operations optimally.

Common operational challenges in compliance processes

Scarcity of

skilled talent

Inconsistent

customer outreach

leading to negative

client experience

Process

inefficiencies

Traditional

technologies and

system solutions

Fragmented

data

Inconsistent quality

and inadequate

training

Labour intensinve

operations

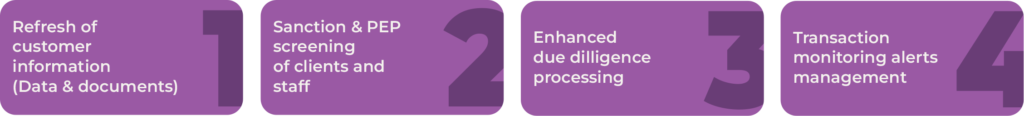

The solution to these challenges

Where we come in

Cost Reduction

Enhanced Customer Experience

Improved Risk Management and Financial Crime Compliance

Building Onshore Solution with Skilled Resources

Scalability

Improved Quality

Cost Reduction

- “Pay as you go” cost effective operating model

- Option to cap monthly fees based on agreed number of cases

- Targeting 30% to 50% cost reduction by automating significant manual processing

Enhanced Customer Experience

- Intelligent automation of repetitive tasks and Work-flow case management

- Online channels for self service capabilities

- Ingest available public information direct from primary sources

Improved Risk Management and Financial Crime Compliance

- Independent client outreach model eliminating chances of collusion

- Site visits and verifications to strengthen the control framework

- Regulatory assurance due to independent and credible engagement

Building onshore solution with skilled resources

- Professional client handing of experienced and trained resources

- Enhanced training and development capabilities

- Providing in country data security comfort to regulators due to onshore presence

Scalability

- Economies of scale being a centralised hub for multiple players

- Cloud Infrastructure to manage increase in volumes

- Improved transparency into operational productivity, quality, capacity and forecasting

Improved Quality

- Achieving bank’s / FI’s internal quality standards by achieving consistent pass rates at QA

- Build a culture of quality by aligning performance scorecard based on quality thresholds

- Engagement with the local regulators to seek explicit approvals of outsourcing